There may have been years when running a restaurant was easy, but you'd have to go way back to find them. As expected, last year was another roller coaster ride with plenty of chills and thrills.

The economy, like a third-rate marathon runner, gasped for air month after month as the threat of war eventually exploded into the real thing. A dictator got his comeuppance, but fears of terrorism have not faded and are not likely to in this lifetime. Add to that obesity lawsuits, an Atkins-crazed public, year-end scares about the food supply (Can you say Mad Cow disease?) and you'd think we might as well give up, pack up, and go home.

Fagetaboutit! This is a resilient industry that has hung tough while others withered in the heat of a bad economy and a wacky political climate. The foodservice industry grew last year, and has confident hopes of catching a second wind as the economy charges toward what appears to be a solid recovery.

One thing has become increasingly clear during the hard times of the last few years: Restaurants have proven to be places of comfort and joy that weary consumers can count on. When someone walks through your doors these days, they carry some heavy baggage, and the smiling faces of you and your staff mean more than they ever did before. You may not be the Red Cross, but you're dispensing some pretty strong medicine.

Once again , full service restaurants will lead the pack,... with sales projected to reach $157.9 billion this year.

Hope for the future

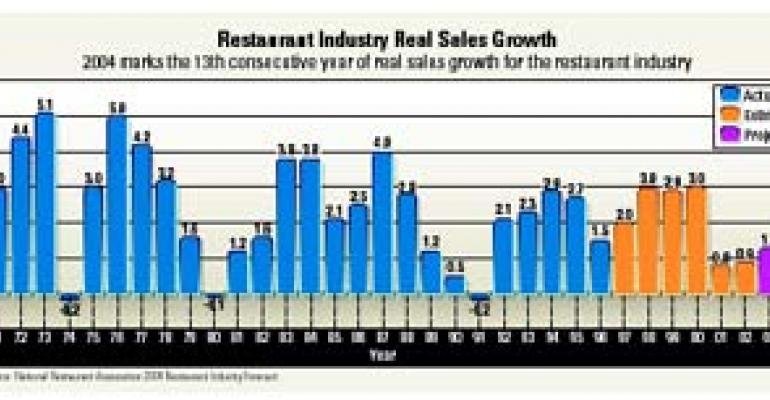

The folks at the National Restaurant Association are smiling. They predict that restaurant-industry sales will climb to a record $440.1 billion this year, which is an increase of 4.4% over last year (or 2% when adjusted for inflation). Last year's inflation-adjusted gain was only 1.3%.

The folks at the National Restaurant Association are smiling. They predict that restaurant-industry sales will climb to a record $440.1 billion this year, which is an increase of 4.4% over last year (or 2% when adjusted for inflation). Last year's inflation-adjusted gain was only 1.3%.

If all goes as expected, 2004 will be the 13th year in a row of real sales growth for the industry.

Once again, full service restaurants will lead the pack, with sales projected to reach $157.9 billion this year. That's an increase of 4.6% ($6.9 billion) over last year, or a real growth rate of 2.1%.

Once again, full service restaurants will lead the pack, with sales projected to reach $157.9 billion this year. That's an increase of 4.6% ($6.9 billion) over last year, or a real growth rate of 2.1%.

The NRA reports that sales at quickservice restaurants will also experience an increase this year, but less than that of its full service counterparts. QSR cash registers are expected to ring out at $123.9 billion in sales, which is an increase of 3.9% (nearly $4.7 billion) over last year (1.5% inflation-adjusted).

Overall, the national economy is building steam, with the gross domestic product (GDP) projected to increase at a rate of 4 percent this year. By comparison, last year's GDP increased by only 2.9 percent.

Most important for the foodservice industry, consumers will likely have more cash in their pockets this year than last as disposable personal income is expected to grow.

Despite hopes for an improved economy, full service restaurant operators—particularly those in fine dining—said that the economy is their chief concern this year, according to an NRA survey. Nevertheless, most expect economic conditions to improve along with their sales totals.

A case of momentum

In our minds, 2003 was a tough year. On paper, it appears much better, says Bob Derrington , an equity research analyst at Morgan Keegan & Company, which tracks publicly traded restaurant companies. 2003 started miserably, but after the Iraq War ended, a steady improvement began. By August, consumer spending accelerated, as did same-store sales and restaurant stock prices. He attributes a chunk of that to the federal government's tax rebate.

In our minds, 2003 was a tough year. On paper, it appears much better, says Bob Derrington , an equity research analyst at Morgan Keegan & Company, which tracks publicly traded restaurant companies. 2003 started miserably, but after the Iraq War ended, a steady improvement began. By August, consumer spending accelerated, as did same-store sales and restaurant stock prices. He attributes a chunk of that to the federal government's tax rebate.

"I expect a strong performance in this first quarter because consumers are more upbeat and positive about the job market and their own personal income," says Derrington. "That should translate into improved same-store sales. As the year progresses and the job market picks up, so will consumer spending."

This is the year, he predicts, that the industry can move to increase menu prices, which are needed to offset rising operating costs and escalating commodity prices, particularly in the areas of protein. Because the economy is improving and consumers are feeling better about their job security, price increases can be made, says Derrington, as long as they're done " intelligently." A dime increase here, a 20-cent jump there will not overwhelm customers, he says.

Casual dining reigns

The full service sector will likely achieve the best results this year and, within that sector, casual dining will rule (as opposed to family and fine dining), reports the NRA. Baby boomers, the nation's largest demographic group, go to casual dining restaurants more than any other age group, most likely because of its $10 to $20 check averages.

The full service sector will likely achieve the best results this year and, within that sector, casual dining will rule (as opposed to family and fine dining), reports the NRA. Baby boomers, the nation's largest demographic group, go to casual dining restaurants more than any other age group, most likely because of its $10 to $20 check averages.

According to projections by the U.S. Census Bureau, nearly one in five Americans will be between the ages of 50 and 64 (see chart) by the end of the decade. Baby boomers, who have long dictated trends in this country, will continue to do so for years to come. If you're not taking into consideration the aging population in all aspects of your operation, you're making a mistake.

A key to success this year, say a majority of all full service operators, is creating and maintaining repeat customers. Most say that much of their sales come from repeat customers, but that maintaining customer loyalty is more difficult than it was two years ago.

That's particularly true for fine-dining restaurants, where 63 percent surveyed by the National Restaurant Association confirmed the truth of that statement.

Customer loyalty is a huge concern, agrees Rich Melman , whose Lettuce Entertain You Enterprises in Chicago runs dozens of restaurant concepts. Customers are mentally exhausted and they want to be taken care of.

"I'm cautiously optimistic this year," he says. "But with increasing competition and the rising costs of doing business, we know we're going to have to be focusing on the customer more and more."

Melman says he'll be paying particular attention to customers over age 40, who have the most disposable income. His strategy is to increase the number of smaller plates of food offered at his restaurants and add more healthful menu items, as well. Melman's even opening a Cafè Ba Ba Reeba—one of the country's first tapas-style restaurants—in Vegas this year, 19 years after the original opened in Chicago.

"At the end of the '80s and into the '90s customers wanted huge portions," he explained. "The Baby boomers are now older, and they're eating more intelligently. They want smaller, better portions and more choices for healthful eating."

This is the year that the industry can make moves to increase menu prices.

Melman's convinced that the current health craze is not a fad that will fade away. The Atkins Diet may recede, he said, but health and nutrition, particularly for those over 40, is here to stay.

Melman's right-on with his views on nutrition and the public's eating habits, says Clark Wolf , a New York City consultant who works with clients around the country.

"High protein and controlled carbohydrates will be with us as long as we live. This Atkins-style diet is the best thing we've seen in 30 years because we've finally found something that is not based on abstinence or exhaustion," says Wolf. "This is the year of high-quality protein."

Wolf also points to Las Vegas, where he says Hubert Keller, who has been cooking cutting-edge French food at Fleur De Lys in San Francisco for years, will be opening a restaurant that will feature 16 hand-made burgers. There's a lesson here, he says. If you put all your money around the product (packaging, promotions, advertising, etc.) and not into the product, customers will eventually seek out a better product. The fast feeders are now discovering this lesson and the fast-casual segment has proven that a very good product in a fast-food setting can be very successful, says Wolf.

A quality product and a desire for more healthful eating are two reasons why customers are steering toward smaller portions and restaurants that offer them.

"There are some people who want their own damn plate of food, but most love to see a table full of small plates," says Wolf. "People feel they are in charge and are getting a good deal when they are spending under $10 for a plate, even though they may end up spending-more for the experience."

It's all about giving the customer what they want, says George Schindler , a partner with Hospitality Restaurants, which operates three Cleveland-area restaurants and plans to open a fourth later this year.

"The economic situation has been tough, but we've always made a real effort to develop intimate relationships with our guests," he says. "We want to take care of the guests we have so they come back. And we want to make sure that the guests who couldn't come because of the economy will come back when it improves because they remember how well we treated them."

The worse things are, the more on top of your game you have to be, says Schindler. "Our people don't hit the floor until we make sure their clothes are starched and their ties are straight. Don't think our customers haven't noticed."

They have noticed, and it's why Schindler's downtown upscale seafood restaurant has been open six years and his two neighborhood restaurants (a steakhouse and a casual seafood house) have been open more than 10 years.

An upscale shakeout

It's no surprise that the upscale segment has taken its lumps in recent years because of the depressed economy. But fine dining is not dead, says Wolf.

It's no surprise that the upscale segment has taken its lumps in recent years because of the depressed economy. But fine dining is not dead, says Wolf.

When the economy was good, people who had a lot of money and very little knowledge of the business opened expensive places. But a bad economy has a way of putting people out of business who had no business being there in the first place, he says. Wellrun upscale restaurants survive bad times and thrive in good times.

That's true, says Michael Bauer , the food and restaurant editor for the San Francisco Chronicle, but a bad economy stifles the opening of big, important restaurants. That's certainly been the case in San Francisco, one of the cities hardest hit by the economy. The good news, he says, is that the restaurant scene has improved dramatically in the last few months, which may eventually lead to grander restaurant openings. Meanwhile, he says, there's been an emergence of small neighborhood restaurants.

"This will definitely be the year of the neighborhood restaurant, and that's good," says Bauer. "We're seeing some great little places opening in the neighborhoods and they're being run by very talented people."

Though the economy may be recovering, Bauer is concerned that the restaurant industry will suffer from the recently passed living wage in S.F., which mandates a minimum wage of $8.50 an hour for all restaurant employees.

Ralph Brennan , a member of the legendary Brennan family of New Orleans, said restaurants in that city went to court to defeated a proposed living wage a year-and-a-half-ago. It was a sign of relief for a city that has struggled since 9/11 because of declining international travel and convention business.

Nevertheless, he's seeing signs of recovery. International travel is picking up and the convention business is turning around. "I'm cautiously optimistic this will be a good year," says Brennan. "But another terrorist attack could stifle business again."

Cautious, yes, but not so much so that it stopped Brennan from opening a new restaurant— Ralph's on the Park—just recently. And surprise, surprise, it's a neighborhood restaurant. "It's in a residential district and it's billed as a neighborhood restaurant for locals by locals, though everyone is welcome," says Brennan.

As you might expect from the Brennans, it's no corner joint. Their version of a neighborhood restaurant has 130 seats and two private dining rooms upstairs, but it features local ingredients and truly targets locals because it's located well off the beaten path of the French Quarter.

When it comes to the trend for healthful eating, one that New Orleans has never been known for, Brennan says it's a non-issue for better-quality restaurants, no matter where they are. Good restaurants, he says, offer their customers a wide variety of options and will gladly adapt to customer preferences.

Drew Nieporent , whose Myriad Restaurant Group operates several highprofile restaurants in New York City and around the country, says the obesity lawsuits were a wake-up call for the industry, which may have been cavalier about health-related issues.

"It's important we know what's in the food we serve," he says. "People have health issues, such as allergies, and we must be very sensitive to their concerns. If someone says they want decaf coffee, we better damn well pour them the right coffee."

Concerning the upswing in neighborhood restaurants, Nieporent says it's often a function of high rents, which has long been a thorn in his side and the reason he created several restaurants in Tribeca when it was still largely undiscovered. One of those restaurants is Montrachet, a 19-year-old restaurant that took somewhat of a financial hit because of the reaction of some during the Iraq War to everything that is French.

"This country really has to reevaluate how it reacts to wartime events," he said.

All in all, Nieporent is optimistic that the year ahead will be fruitful for all who focus strongly on customers and give them what they want, and who do it as professionally as they can.

That's certainly the goal at the highest grossing chain restaurant in the country, The Cheesecake Factory.

"We have 200 menu items, and because we make every item fresh, customers can modify a dish any way they want," says Howard Gordon , senior v.p. of business development. Nevertheless, the chain is training its staff to assist customers with dieting questions and guide them with their selection.

"We've been criticized for our name because cheesecake is a high-calorie item," says Gordon. "And it is. But good restaurants are there to take care of their customers' desires, and that ranges from a piece of grilled fish to a sinful piece of cheesecake. That's what this business is all about."

It also explains why the chain will open 14 more units this year and two more units of its more casual upscale sibling, Grand Luxe Cafes. Success, no matter what year, comes when you fulfill needs.

"This will definately be the year of the neighborhood restaurant "

10 Trends to Watch in 2004John Mariani, a contributor to Esquire and Restaurant Hospitality, frequently eats his way across the country. Here are the trends he sees in the year ahead: 1. Counter Space. The daunting successes of Tom Colicchio's Craftbar in NYC and Vegas and Joel Robuchon's L'Atelier in Paris signal a real momentum in fast food at a high level of culinary expertise. Fifty and 60-seat counters are becoming the norm—right out of Schrafft's or Woolworth's. 2. Snack Away. Call 'em what you will—canapÈs, tapas, mezes, antipasti—grazing on small dishes of fairly exotic Mediterranean and Asian food has caught a wave. Reality check: Zatinya in D.C. 3. More Beef! Despite a seeming surfeit five years ago and a still-recovering economy, and despite even the threat of Mad Cow Disease, there's no stopping the opening of more top-dollar steakhouses in the U.S., with 11 now open along one highway in Dallas alone, and one on each corner of a Vegas cross street. More to come everywhere. 4. Sushi Rules. Maybe it's a chef thing, but more American cooks seem committed to showing what they can do with sushi within their own personal style, and the stuff is proliferating in the most refined ways, e.g., Marcus Samuelsson's hot new Riingo in NYC. 5. Italian-American Comeback. Despite Rocco DiSpirito's best efforts to prove Italian-American food is nothing but oversauced glop, the genre is taking wing among young American chefs, who are getting nostalgic for the good tastes of Italian-American food and who are doing it in stylish new places with lots of real gusto and at prices just about anyone can afford. 6. Comfort Food Goes Home. The knee-jerk post-9/11 interest in socalled comfort foods—meatloaf, mashed potatoes, roast chicken—has lost much of its steam-table spirit as Americans turn away from such items for fancier viands they're willing to spend a little more money on. 7. Shorter Is Better. Except perhaps in Las Vegas, where the ba-da-bing factor still rules, wine lists will get smaller, but better as young wine stewards pack sensible lists with precisely the best wines to go with the individual menus in their restaurants, and with plenty of New World offerings. 8. No Smoke, No Sweat. The current, quite understandable brouhaha over fears that no-smoking laws will cut into restaurant business will fade, as has all health rule opposition in the past. More and more states will pass laws impossible to stop that will ultimately be advantageous to one's health costs, fire insurance, and threat of lawsuits. 9. The Real Latino. Nuevo Latino has legs, but it's the modern cooking of young Spanish chefs that is really creating headlines. Look for more adventurous Spanish restaurants this side of the Atlantic, led by chefs like Luis Bolo of Ibiza in New Haven and Arturo Boada of Beso in Houston. 10. Be Afraid, Be Somewhat Afraid. It is, I'm sorry to say, bound to happen: International terrorism is not going to look always for the big score as on 9/11, but, as in Israel and Indonesia, to those venues where terror truly takes hold, and that means restaurants. Good security is cheap, compared to the alternative. As Ron Paul Sees ItFor decades, Ron Paul, president of Technomic Inc., a leading foodservice consulting firm, has had his finger on the pulse of the industry. He sees a good year ahead and suggests you keep your eye on the following five issues: Impact of the "obesity crisis" will continue. "We believe these efforts will provide additional incentives for consumers to use food service as the solution to their eating needs," Paul says. Demand for quality will accelerate. Concept proliferation will occur. Selected segments will struggle. Consolidation will continue on all levels. Ten Trends from WolfWhat will be the big trends of 2004? Here's what hot shot New York City consultant Clark Wolf thinks:

|